ABC of Remittance Inflow in Bangladesh

ABC of Remittance Inflow in Bangladesh

Written by: Protyasha Chowdhury & Md. Atiqul Islam

Derived from the verb “to remit” meaning “to send back”, the term “remittance” describes the money that an expat worker sends back to his home country. Many people in Bangladesh leave their homeland in search of work, and those who do so send money back to their loved ones back home. Four hundred thousand Bangladeshi workers leave the country every year, according to the International Labor Organization (ILO). 7.5 million people from Bangladesh are now employed outside of their home country, according to data compiled by the Bureau of Manpower, Employment, and Training (BMET). The survey also notes that a portion of these employees go to the West, while others go to the MENA and Southeast Asian regions.

The New Age Bangladesh, a national daily, reported a $21.74 billion influx to Bangladesh in 2020, a year in which many people lost their jobs as a result of the CoV19 outbreak, and economies throughout the world experienced a recession. The study went on to claim that remittances will bring in $22.07 billion to Bangladesh in the next fiscal year. Remittance inflow in 2021 reached $22 billion which was somewhat close to the assumption.

Who are these migrant workers?

There are mainly four types of migrant workers: white-collar, skilled, semi-skilled, and blue-collar. Professionals with advanced degrees tend to work in white-collar fields like medicine, engineering, education, and the like. Professionals in the textile and manufacturing industries are considered skilled employees. Those who work as tailors or masons are considered semi-skilled workers, while those who work as housekeepers and laborers are considered blue-collar workers.

How is remittance sent to Bangladesh?

Emigrant workers transfer money to Bangladesh through money transfer companies like Western Union, Bkash, MoneyGram International Inc, and banks. Western Union, operating in Bangladesh, allows money to be sent from a foreign country into the bank account from which cash is withdrawn by the receiver or deposited on a prepaid card. Bkash allows the transfer of money from abroad directly into the Bkash account through the exchange houses and bank branches it has collaborated with. Moreover, Bkash offered its users a 1% cash bonus when they received remittances until 31st January 2021. When sent through MoneyGram, the money is deposited to the receiver’s bank account or mobile wallet.

How does remittance benefit the economy of Bangladesh?

The economic and financial growth of Bangladesh benefits greatly from remittances. For example, when a blue collared worker sends money to his or her family, which may live below the poverty line, it diminishes their credit constraints; as impoverished households cannot borrow money against their future income and have a hard time repaying loans. In addition, when a white collared worker sends money home, it increases the family’s expenditure while raising their living standard. Even though remittance is a non-commercial transaction, it bolsters the economy of Bangladesh when the money is spent in the domestic economy.

Tax or incentive on remittance?

The Daily Star reports that the National Board of Revenue announced that the government of Bangladesh did not impose any tax on remittances sent into the country (No vat on remittance Report, 2018), meaning migrant workers can send any amount of money to Bangladesh without paying taxes. It also prevents the international transfer of money into Bangladesh through illegal channels.

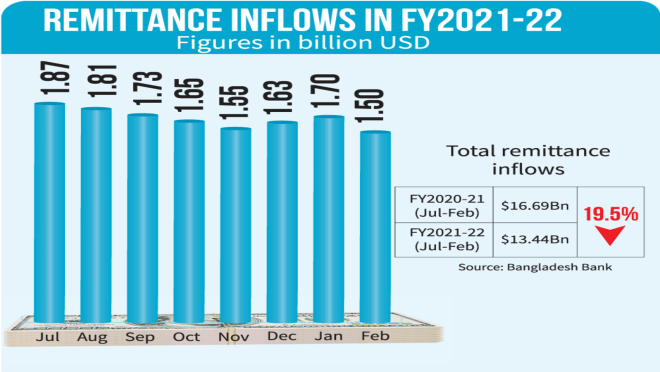

On the other hand, the government of Bangladesh provides incentives for remittance exchange rates. The incentive on the remittance exchange rate was 2% which was then shot up to 2.5% by the Ministry of Finance. This was done as during the last half of the fiscal year 2021, there was a 21% fall in the transfer of money from emigrant workers (TBS Report 01 January & Report, 2022). The increase in incentive would cover the expense of transferring foreign currency to Bangladesh.