GameStop’s rollercoaster ride: How a meme stock shook Wall Street

GameStop’s rollercoaster ride: How a meme stock shook Wall Street

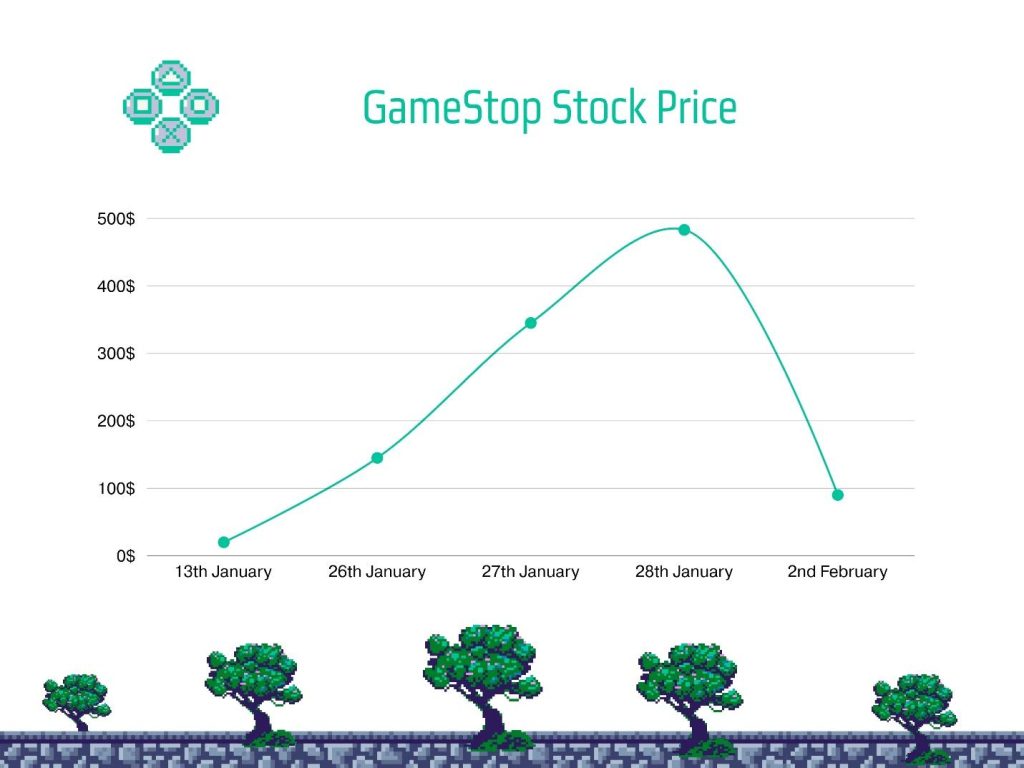

Can you imagine this? A stock priced at just $20 suddenly skyrockets by an astonishing 2,315% within 15 days from 13 to 28 January 2021, closing at a jaw-dropping $483! Yes, you assumed it right—we’re talking about GameStop!

This company, which wasn’t doing well and was heavily shorted by hedge funds and became the talk of the town when retail investors from the reddit meme community decided to shake things up. In a spectacular twist of fate, this online community turned Wall Street on its head, transforming the world of investing into a thrilling spectacle that no one saw coming. Before that lets make the term short selling easier for all. It’s a trading strategy where the investor borrows shares of a stock from someone, sells them at the current price and waits for the price to fall. And later buys back the share at lower price to return the lender, pocketing the differences as profit.

So, in short, short selling is a method of benefitting from dropping asset prices.

It is the process of betting on a stock that you know will fall. If the prices spiked that is the endgame for you.

So, as GameStop wasn’t doing its best so the stock was heavily shorted, with more than 140% of its float shorted (A situation where more shares were shorted than there were actually available to trade). Melvin Capital was one of the largest hedge funds that shorted GameStop significantly.

It all started on Reddit, in a group called r/WallStreetBets, where users joked about stocks and exchanged amusing memes. One of the stocks they discussed was GameStop, a struggling video game retailer whose stock price many hedge funds expected would collapse.

Instead of walking away from GameStop, the Reddit community saw this as an opportunity to take on Wall Street. They started buying up the stock, increasing its popularity, thus driving the price higher. The more on board, the higher the stock price, the more loss was incurred by the hedge funds who bet on it.

What started as a meme and laughs very soon turned into a huge financial event that did not leave Wall Street unscathed. The Indian traders were also encashing in their investment in the stock. For instance, Ujjwal Singhania, son of Sunil Singhania, purchased GameStop at $10 per share and earned a return of 3,450%.

While the price is skyrocketing, do you remember the billion-dollar hedge firm Melvin Capital, which shorted a large chunk of GameStop stock?

Melvin Capital lost around $6.8 billion in January 2021 as a result of the short squeeze, and the firm required a $2.75 billion bailout from other hedge funds, including Citadel and Point72, to stabilise its operations following the large losses experienced during the GameStop event.

The retailers basically gave the rich hedge funds a message: ordinary people, too, can send shockwaves into the financial world. Working on Reddit, they proved pretty well that influence isn’t reserved just for large investors; retail traders also mean a lot.

What can we learn?

The GameStop event demonstrated that the financial world is shifting. Social media and online forums have enabled ordinary people to exert influence on stock markets that were previously dominated by large institutions. It also shown that betting against a corporation (short selling) may be dangerous, particularly when unexpected occurrences cause the stock price to rise.

Most importantly, it reminded everyone that markets are more than just statistics; they are also about people and emotions. Even the biggest players may affect the game when they work together.

GameStop stock price in short

13th January – $20 26th January- $145 28th January- $483