Know Your Taxes: Guide to Your Strategic Financial Planning

Know Your Taxes: Guide to Your Strategic Financial Planning

One aspect of personal finance that requires careful consideration is the calculation of income tax on salary. Ignoring the methods used in income tax computations can result in incorrect tax planning or paying more in taxes than necessary. However, knowing how to manoeuvre through the maze of tax laws serves as a powerful instrument for people who want to make well-informed decisions regarding their income.

Generally speaking, who ought to be aware of the income tax calculation? Well, the target audience is primarily young professionals who are seriously considering and have recently accepted their first job and who are invested in the concept of sound financial planning. However, the method used in the calculation will also be helpful to the average individual, or perhaps even to a seasoned expert who still doesn’t get his way with the income tax calculations.

Let’s use a hypothetical situation to illustrate how income tax is actually computed-

In the income year of 2022-23, Mr Kabir, a product manager for a local private company, received Tk45,000 on monthly basis. He was also given a medical allowance and a dearness allowance, each worth 10% of his base pay. Two festival bonuses, each worth one month’s basic pay, were also given to him. He received a monthly conveyance allowance of Tk10,000 and house rent allowance equal to 10% of his base pay. Additionally, he has Tk400,000 in allowable investment.

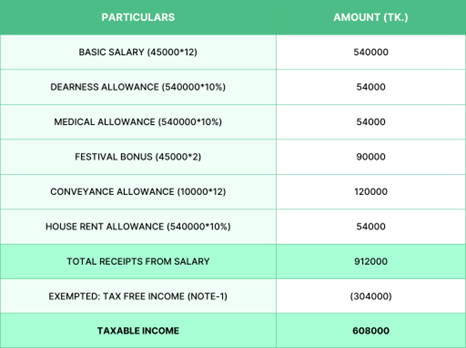

Step-1: Calculating Taxable Income

Let’s start by adding up the earnings from the employment and creating a salary statement. Excluding tax-free income from the total amount of salary receipts allows one to compute taxable income.

Note: Tax-free income is the lower of, 1/3rdof the total salary income or Tk450,000

In this case, 1/3rdof the total salary income = 1/3rdof Tk912,000 = Tk304,000.

So, the lower, Tk304,000 is exempted as tax free income.

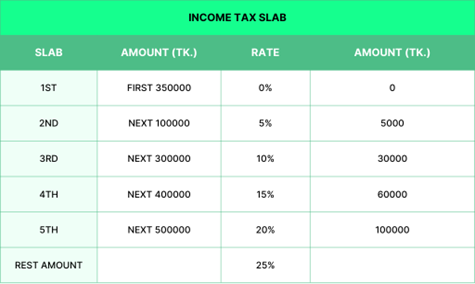

Step-2: Calculating Gross Tax Liability Using Tax Slab

Income tax slabs are tax rates that are applied to specific income ranges. It assists in figuring out the tax payable on a certain portion of the total comprehensive income.

Though the amount of first slab depends on the individual’s criteria. For example: In the case of men, the amount of the first slab is Tk350,000.

In case of individuals of other criteria

For women and individuals 65+ age: Tk400,000

For individuals with disability and third genders: Tk475,000

For freedom fighters: Tk500,000

Referring back to Mr Kabir’s situation, let’s use the income tax slab to determine how much his gross tax liability is.

The taxable income of Mr Kabir is Tk608,000

1st Slab: 0% of first Tk350,000 = Tk0

2nd Slab: 5% of next Tk100,000 = Tk5,000

3rd Slab: 10% of rest Tk158,000 = Tk15,800

Therefore, his gross tax liability stands out to be Tk (5000+15800) = Tk20,800.

Step-3: Net Tax Calculation

In this final step, the net tax that is to be finally paid can be calculated by deducting any tax rebates from the gross tax liability. Since Mr Kabir had an allowable investment of Tk400,000, let’s calculate the tax rebate on this.

Rebate Calculation: Lowest of –

- 3% of taxable Income = 3% of Tk608,000 = Tk18,240

- 15% of allowable investment = 15% of Tk400,000 = Tk60,000

- Tk1,000,000

Whichever is the lowest, will be counted as rebate on gross tax liability. Since the amount Tk18,240 is the lowest, this will be deducted from the gross tax liability as tax rebate.

Note: Any jobholder owning a car will have to pay tax rebate on environment pollution according the tax schedule in NBR website.

Net Tax Payable = Gross Tax Liability – Tax Rebate

= Tk(20,800-18,240)

= Tk2,560

Now we know that Mr Kabir will have to pay Tk2,560 as his income tax for the income year 2022-23.

The aforementioned case study and associated computations merely provided a skewed understanding of how the income-based tax system operates and how it is enforced. The next time we receive a salary statement at the end of the fiscal year, we can handle our own taxes without the trouble of speaking with a tax consultant and we won’t have to worry about inadvertently paying extra taxes. A little knowledge goes a long way.